What’s Working in Audience Development?

How Publishers Are Driving Audience Growth and Managing Audience Data in 2025

Debra Aho Williamson

Contributing Analyst, The Rebooting

13 March 2025 — 9 min read

Audience.

It’s the key to success for publishers. And the formula is simple:

Bigger audience + deeper relationships = more monetization opportunities.

But the path to achieving this is more complex than ever. The past decade was defined by platform-dependent growth strategies, but in 2025, media businesses face an inflection point:

- Generative AI is reshaping search and traffic patterns.

- Social media platforms continue to reduce referral traffic.

- Media fragmentation has disadvantaged institutional publishers.

To thrive, publishers must shift from renting audiences on external platforms to owning relationships through newsletters, direct engagement and differentiated content.

But successfully building and nurturing an audience is a complex and evolving area, requiring a mix of innovation, adaptability and strategic investment.

Managing audience data is equally complex. Information is often siloed across multiple platforms and teams, and though gathering it might be easy, making sense of it and activating against it are still challenging.

To better understand how media companies are driving audience growth and engagement, The Rebooting conducted a survey of 97 media and publishing industry executives. The survey also explored the impact of AI on audience development and the audience management platforms that media companies are using to make it easier to put their data to work. The survey was complemented with stakeholder interviews with executives at leading publishing companies.

Our research, conducted in February 2025 in partnership with Omeda, identified three overarching shifts:

- The shift to controllable audiences: Publishers are focusing on direct, owned relationships through newsletters, memberships and events rather than relying on algorithm-driven platforms.

- Greater reliance on first-party data and community-building: Collecting audience data is no longer enough; the priority is activating it through experiences that foster engagement and loyalty.

- The AI reckoning: Generative AI is both a challenge and an opportunity, accelerating traffic loss while forcing publishers to differentiate through trust and human curation.

To prepare for these trends, publishers are:

- Prioritizing audience development tactics that balance audience breadth and engagement depth.

- Emphasizing growth opportunities from newsletters and direct traffic, as search and social become less reliable.

- Leveraging AI thoughtfully to build and engage audiences but also creating moats that guard against traffic loss.

- Focusing on subscriptions and events to build first-party data and new monetization pathways.

Publishers are also taking audience development more seriously by:

- Allocating more budget to audience development efforts.

- Working to make audience data management more efficient.

- Using generative AI tools to boost their audience development efforts.

Publishers are Balancing Breadth and Depth in Audience Development

For years, publishers chased scale—maximizing pageviews through SEO and social media referrals. That model is collapsing:

- 50% of publishers reported a decline in search traffic over the past year.

- Organic social media is now a secondary priority, with just 24% of respondents listing it as a primary traffic source.

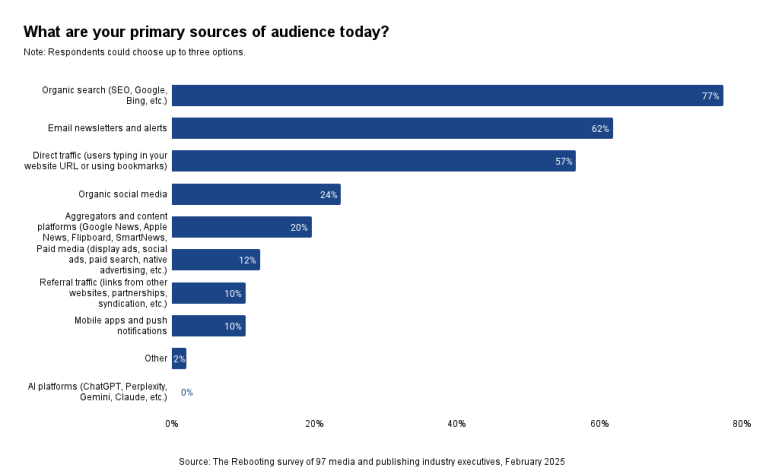

- Newsletters (62%) and direct traffic (57%) are increasingly seen as the backbone of audience growth.

Yet even as publishers are in the midst of realigning their business, they must continue to operate the existing business. The top audience development goal for publishers in 2025 is to increase traffic, our survey found. At the same time, publishers are also doing more to boost the depth of engagement with their audiences.

The shift from focusing mostly or solely on audience scale to creating audience depth is a strategic necessity. Publishers that emphasize community-driven engagement will be best positioned for long-term sustainability.

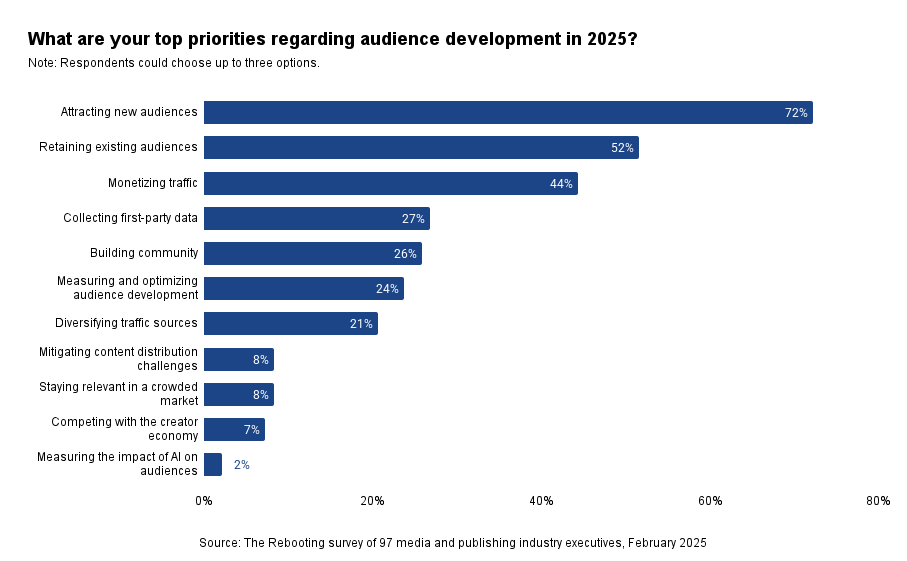

Audience size still matters—a lot. Nearly three-quarters (72%) of survey respondents said attracting new audiences is a top priority.

Creating deeper relationships is also a top goal. More than half (52%) of publishing executives are prioritizing audience development efforts that focus on retaining existing audiences. And roughly one-quarter are emphasizing collecting first-party data (27%) or building community (26%).

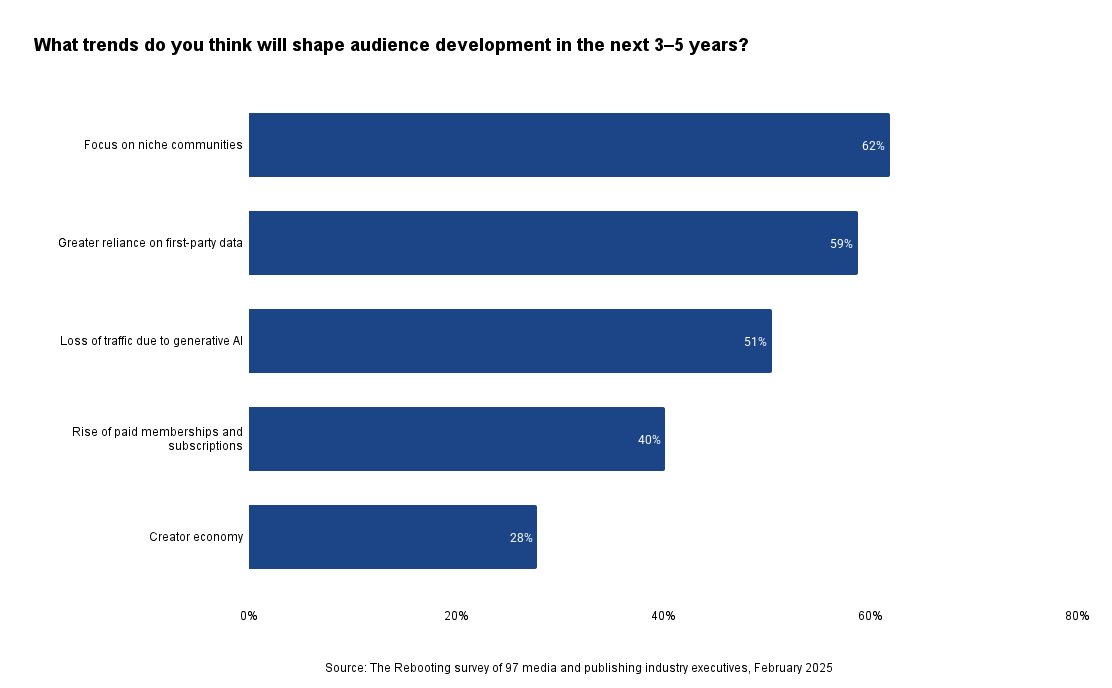

Publishers know they need to build breadth and depth simultaneously. When we asked respondents to rank seven aspects of an audience development strategy, based on the importance to achieving their goals, 62% put “grow audience size and reach” either first or second and 58% did so for “increase audience engagement.”

Pro Tip: Treat users differently at each conversion stage

“The number one source of building audience and building scale is funnel and conversion. I don't necessarily mean conversion to a paid subscription, but conversion to that next stage of loyalty. Every day we get an audience of millions who come to us, but it is a very leaky bucket. Now those pages are the start of a user journey. We’re doing all we can to incentivize registration, but it’s really about figuring out how to treat users differently at each stage.”—Head of audience development at a major news publisher

Newsletters and Direct Traffic Are Getting More Priority as Search Loses Some Steam

Publishers are realizing they must understand their audiences in order to foster long-term loyalty.

- First-party data collection is one of their top audience development priorities. It ranked fourth in our survey, after big-picture goals such as attracting, retaining and monetizing audiences.

- Subscription growth is now a core strategy for publishers to build a direct connection with their audience.

- Community-building via events is emerging as another differentiator, particularly for niche publishers that can foster high-value engagement.

Email newsletters and alerts are a top audience-building strategy. More than six in 10 respondents said these types of loyalty-building products are a primary source of audience today.

Newsletters are an important strategic channel for future audience development. 58% of respondents said traffic from newsletters and alerts had increased vs. the past 12 months. And when we asked respondents to rank various platforms and marketing channels based on their importance to an audience development strategy, 31% said email newsletters were their number one priority—further evidence that audience development tactics that drive loyalty and first-party data are important strategies for 2025.

Pro Tip: Shake up content offerings to entice more registrations

“We're trying to drive more registrations and subscriptions and have more reasons for consumers to share their first-party data and want to connect with us as registered users. We're diversifying our content offering, focusing a lot more on service journalism, evergreen content and more than just breaking news.”—Head of product, major news publisher

Direct traffic is playing a bigger role. Not only was direct traffic (typing in a URL or using a bookmark) the No. 3 primary source of audience among respondents, nearly half (47%) said direct traffic had increased vs. the past 12 months.

Organic search is the top traffic driver, but search is much less reliable than it used to be. More than three-quarters (77%) of respondents said it was a primary source of audience. However, half of respondents (50%) said the amount of traffic their publications get from search engines has decreased in the past 12 months. Large publishers were more likely to have been impacted than smaller ones; 54% of respondents with a monthly audience of 1 million or more said search traffic had decreased, vs. 41% of small publishers (monthly audience of 1 million or less).

Despite the challenges with search, publishers still consider Google the most important platform for audience development. 53% of respondents ranked it first among platforms and tactics based on their strategic importance to an audience development strategy. Although search is a big part of Google’s appeal, it also offers other features, like Google News, Google Discover and YouTube, which all serve as traffic drivers.

Pro Tip: Keep using Google, but be prepared for future changes

“Google is still the best source of new users. And so for us, it's all about recognizing that that is what's putting gas in the tank today, and we cannot walk away from that strategy. But we also know that that's not going to be with us forever, whether that's a Google algorithm change, whether that's AI, or that's Google prioritizing YouTube content over other publishers in Google Discover. There's a million ways that that could be reduced.”—Head of audience development, major news publisher

Organic social media is down, but not out. Only 24% of total respondents listed organic social media as a primary source of traffic, and nearly 4 in 10 respondents (37%) said the amount of traffic from organic social media had decreased in the past 12 months. Still, social media ranked fourth highest among the sources of audience that we asked about—clear evidence that many publishers still find value in it.

There may be a few reasons for optimism when it comes to organic social. More than a quarter (28%) of respondents said social traffic had increased in the past 12 months, a higher percentage than saw traffic increases from things like referral links (24%) or paid media (19%). A significantly higher percentage of smaller publishers said organic social traffic increased (41%) compared to larger publishers (21%).

Pro Tip: Think of social channels as places for on-platform engagement, not traffic drivers

“Primarily it's about brand building on the social platforms. It's about on-platform engagement. Increasingly, we're thinking about our social channels as another syndicated channel that's monetized separately from the core.”—Head of audience development, major news publisher

“On Meta, we seem to be having more success with branded creative than we used to, which is really exciting, but we're not seeing as much success with promoting our articles.”—Chief growth officer, digital subscription business

Community-building is becoming a differentiator, especially for smaller publishers. 41% of respondents who work for publishers with monthly audiences under 1 million are prioritizing community-building in 2025, vs. just 17% of larger publishers. Events are a key part of their strategy; 31% of smaller publishers said events ranked first or second in priority as an audience development channel, compared with 10% of larger publishers.

Publishers Are Wrestling With the Value of Working With Generative AI Platforms

Many publishers are concerned about the impact of AI platforms on their traffic and content strategies. But for some, AI is also starting to generate more traffic, and it’s something they are prioritizing for audience development.

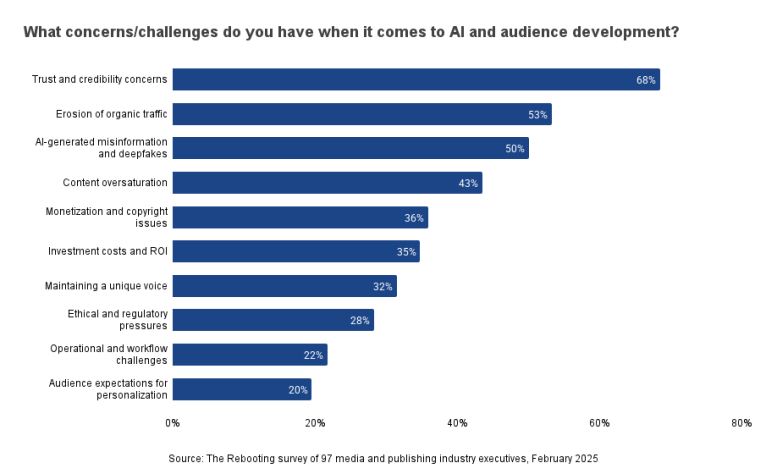

Fears of traffic erosion are keeping publishers up at night. More than half of respondents (53%) said loss of traffic due to AI is an audience development challenge. AI’s impact on organic traffic weighs more heavily on larger publishers than smaller ones; 62% of respondents who work for publishers with a monthly audience of 1 million or more said it was a concern, compared to 37% of those who work for smaller publishers.

Publishers also worry about the potential negative effects of AI on content. Their top concern was the impact on trust and credibility (68%), while the potential for AI-generated misinformation and fakes (50%) ranked third.

At the same time, AI platforms are becoming a bigger source of traffic for some publishers. While no survey respondent said platforms like ChatGPT are a primary source of audience today, that could change in coming years. Nearly a third of respondents (31%) said traffic from AI platforms had increased in the past 12 months. The increases are coming from a small base, but they are notable nonetheless.

When it comes to AI, publishers are pursuing a dual strategy: Partner and protect. In interviews, publishing executives were cautious about working with AI platforms directly, and those with smaller audiences said they are quite comfortable letting their larger counterparts do some of the testing and learning.

Pro Tip: Focus on what makes you unique

“We think about AI in three phases: monitor, protect and monetize. We are definitely taking a little bit of a wait and see approach as far as how deep we get with the platforms themselves. We know that they can take traffic away. But we also know that our way of writing is truly original, so we're not that concerned that AI is going to replace us.”—Chief growth officer, digital subscription business

“Our goal is to try to synthesize things in ways that an AI summary can't quite get to yet, whether that's a creative side door to the story or an angle people didn't know.”—Head of audience development, major news publisher

Subscriptions and Events Are Growing Revenue Streams

Advertising is the most common way publishers monetize audiences, but subscriptions and events are coming into sharper focus as publishers look to deepen their audience connections and drive engagement, which can lead to new monetization opportunities.

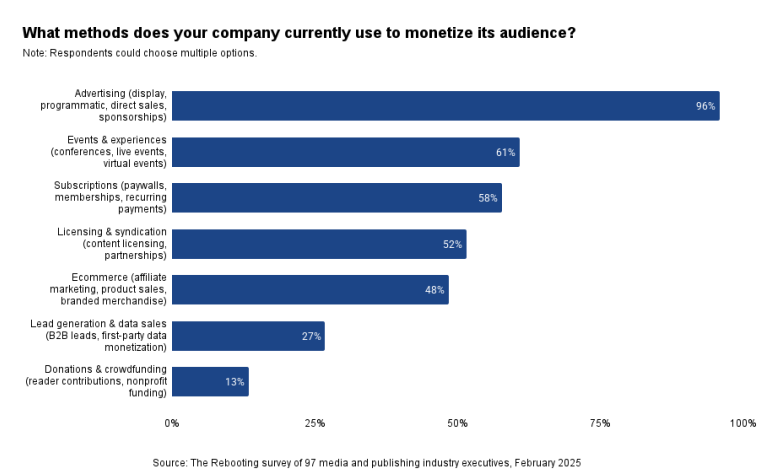

Publishers rely on a variety of revenue sources. Advertising is nearly ubiquitous—96% of respondents said their company monetizes via ads—but more than half of respondents said their company obtains revenue from either events & experiences, subscriptions or licensing & syndication.

Ads are by far the most important revenue source. 60% of respondents said advertising was their primary method of monetizing their audience. Subscriptions ranked next, but they were a primary revenue source for just 17% of respondents.

Publishers are banking on events and subscriptions for future revenue gains. Nearly two-thirds of respondents (62%) expect events to increase in importance as a monetization driver in 2025, while 57% are counting on subscriptions. That was especially true for smaller publishers; 75% of respondents working at publishers with an audience under 1 million monthly said they expected subscription monetization to increase in priority as a revenue stream this year, compared to 46% of those who worked for larger publishers.

Pro Tip: Build a direct relationship with your audience

“Media companies and publishers have to have a direct relationship with their audience, which means they need to have first-party data, they need to understand engagement, and they need to understand who they're talking to. And then they need to create engagement products, whether it's newsletters or events or targeted content or personalizations, for that audience member.”—James Capo, CEO, Omeda

Publishers Are Taking Audience Development More Seriously

As publishers try to boost traffic and increase loyalty in a changing environment, they are setting aside budgets to support their audience development priorities.

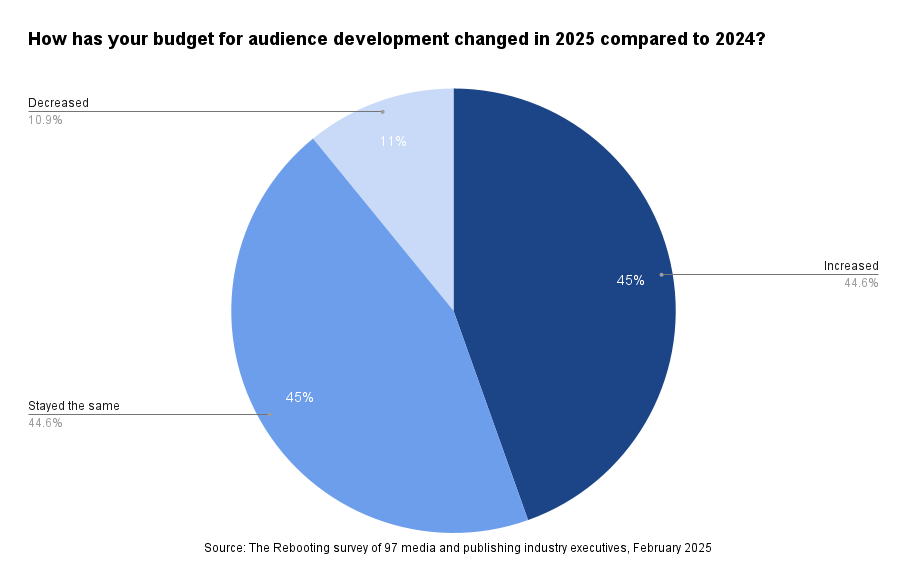

Audience development budgets are rising. Nearly half of respondents (45%) said their company is increasing the budget for audience development this year. Only 11% are decreasing the budget.

Audience development is a budget priority for smaller and larger publishers alike. Among respondents with a monthly audience up to 1 million, 43% said budgets have increased this year, compared to 45% of respondents with a monthly audience greater than 1 million.

Generative AI Tools Are Helping Publishers Meet Their Audience Development Goals

Even as publishers worry about the impact of AI platforms on traffic, they are also increasingly using AI tools internally as part of their audience development efforts. Advances in audience data platforms, including the integration of sophisticated AI data analytics capabilities, are helping publishers streamline audience data management and make better use of the information they’re gathering.

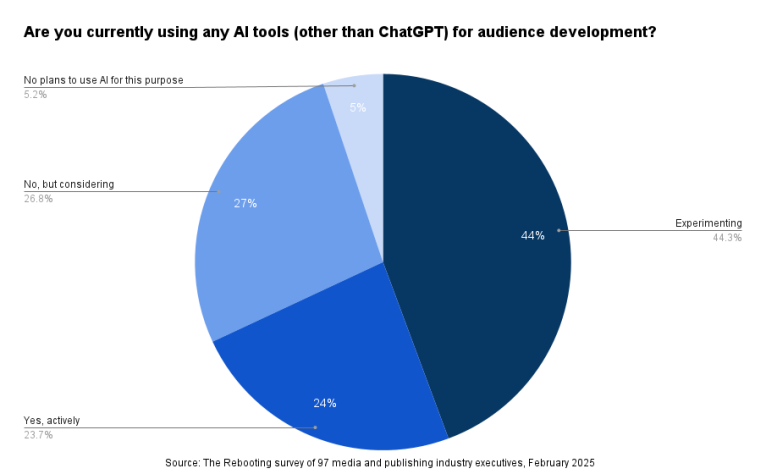

Many publishers are leaning on generative AI to assist audience development efforts. More than two-thirds (68%) of respondents said their companies are actively using or experimenting with AI (other than ChatGPT) for this purpose.

The most common way publishing executives are using generative AI in audience development is for data analytics. Among those that are either actively using or experimenting with generative AI, 60% are applying it to data analytics. In addition, 56% of respondents are using generative AI for search engine optimization and 51% for content creation.

Pro Tip: Use AI for faster, deeper audience analysis

“There is no limit to the questions you could ask, but there is a limit to the number of people that we can actually put behind it. We can't keep up with the amount of insights that we could generate, so that's where AI becomes a muscle that we flex.”—Chief growth officer, digital subscription business

“This is where AI and machine learning and deep learning will really help us, because we can take unstructured or differently structured data sets and bring them together and parse them a lot more easily. There was a time when you'd have to have an army of auditors going through things to be able to line them up. Now it's within reach in a way you wouldn't have thought of before.”—Head of product, major news publisher

“A human can't see the micro audiences that are developing around a topic the way AI can. Say you've got a million people coming to your website, and there's a cohort that seems to be gravitating toward baseball and travel. You might say, ‘Maybe we should create a newsletter that talks about traveling to sports around the country.’ That's the type of stuff AI will let us do. You can productize and launch faster and not only have the content association but the audience association.”—James Capo, CEO, Omeda

Publishers are seeing a positive impact from using generative AI. 64% said it has somewhat or significantly improved their ability to engage or grow their audience, and the rest were neutral. No respondents said that AI had worsened their audience development efforts.

However, publishers are still finding the right level of priority for AI initiatives. When asked to rank their audience development goals, respondents placed leveraging AI and technology for smarter audience insights close to the bottom of the list. And only 2% said measuring the impact of AI on audiences was a top priority—evidence that many publishers have yet to fully take advantage of the capabilities that audience management platforms can offer.

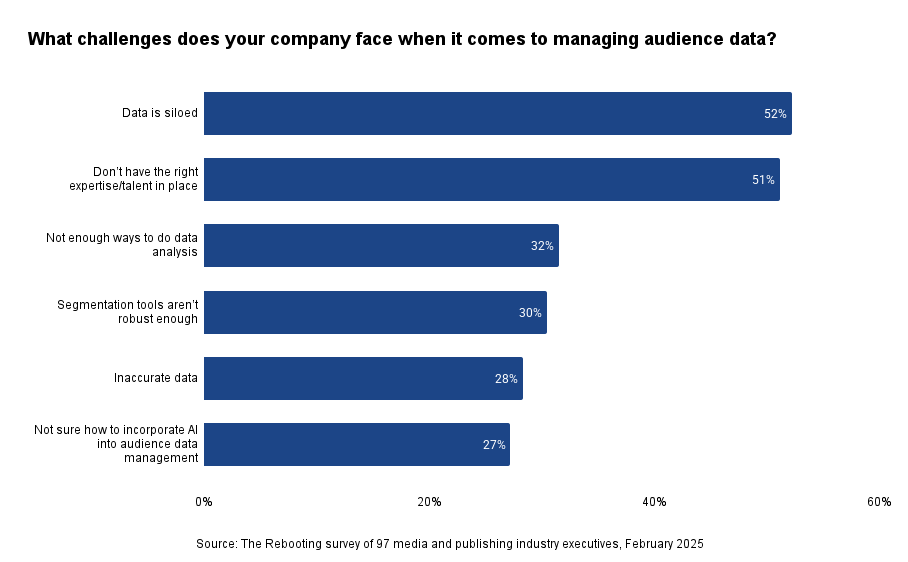

Siloes and Talent Deficits Are Two Audience Development Hurdles

Two essential components of an audience development strategy are having the right personnel and platforms in place to manage and make use of the data. But these are areas that publishers large and small still struggle to manage in their internal organizations. They are also both areas where AI-infused tools can help.

Publishers don’t feel they use their audience data effectively. Four in 10 survey respondents (41%) rated their company’s approach to audience data management either “not very effective” or “not at all effective,” while only 9% called it “very effective.” Those who work for smaller publishers were much more likely to view their company’s approach negatively; 57% rated it not very or not at all effective vs. 39% of those who work for larger publishers.

As one survey taker reported, “We often put data initiatives on the back burner. We’re pretty reactive, not really proactive about it, candidly.”

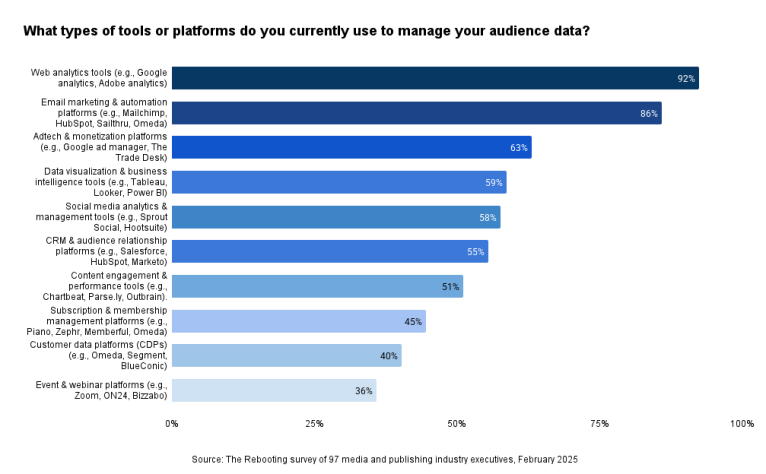

Publishers store audience data in a wide array of tools. The most common places audience data is housed are in web analytics (92%) and email marketing and automation platforms (86%). But more than 50% of respondents said they store data in adtech and monetization platforms, data visualization and business intelligence tools, social media analytics and management tools, or CRM and audience relationship platforms. This leads to inefficiencies; as one survey taker put it, “Too many tools, unable to get a universal view.”

Pro Tip: Put audience at the center

“Having email data in one platform and subscription data in another platform and web data in another platform and maybe even your print subscriber file in another platform, it's just not efficient. The audience is the foundational piece. Think about the audience at the center, and having a platform and services that can put that individual at the middle of everything. Then activate on top of that.”—James Capo, CEO, Omeda

Who owns audience data strategy depends on the organization. There isn’t one clear department or role that manages it. While 25% of respondents said the audience development and growth team has primary responsibility, anywhere from 11% to 18% said it was led by either editorial/content strategy, data/analytics, marketing and brand strategy or technology and product development.

Notably, smaller publishers are much more likely to manage audience data strategy within the marketing department; 23% said marketing had primary responsibility vs. 5% of larger publishers.

Pro Tip: Audience development is a shared responsibility

“When you're talking about how to bring users along on the journey, product and audience need to collaborate. It's all about making sure you have unique and varied content and finding the right niches that have a very high-value audience. You cannot get there with one team or one silo.”—Head of audience development, major news publisher

Siloes and talent shortcomings are the biggest audience data management challenges. 52% cited the perennial problem of data silos, while 51% mentioned having the right staff or talent in place. “We have a vast set of ways our audience can engage with us, and sometimes our data gets so granular that it turns to dust,” one survey taker reported. “A lot of times, no clear strategy comes from it.”

To solve these problems, some publishers are eyeing new audience data platform solutions. About one-third of respondents (36%) have either started implementing a new ADP or are expecting to migrate to a new one, with smaller publishers (47%) more likely to be on this journey than larger ones (30%).

Methodology

The Rebooting surveyed 97 publishing/media company executives in February 2025. Half of the respondents represent companies that target consumers, 19% target a B2B audience and 31% target both. Two-thirds work for companies with a monthly audience of 1 million or greater, and one-third have a monthly audience of 1 million or less.